Low Income Housing Tax Credit

Hope Manor (Chicago)

The Low Income Housing Tax Credit (LIHTC, Housing Credit) is a dollar-for-dollar federal tax credit for affordable housing investments. It was created under the Tax Reform Act of 1986 and gives incentives for the utilization of private equity in the development of affordable housing aimed at low-income Americans. The program is administered at the state level by state housing finance agencies (i.e. IHDA) with each state getting a fixed allocation of credits based on its population. IHDA evaluates applications against our “Qualified Allocation Plan” (QAP).

LIHTC accounts for the majority (approximately 90%) of all affordable rental housing created in the United States today, and is the most successful affordable housing tool in Illinois. The tax credits are more attractive than tax deductions as the credits provide a dollar-for-dollar reduction in a taxpayer’s federal income tax, whereas a tax deduction only provides a reduction in taxable income. Almost all investors in LIHTC projects are corporations.

The maximum rent that can be charged is based upon the Area Median Income (“AMI”) and is capped at 80% of AMI. Rents must be kept affordable for a 15-year initial “compliance period” and a subsequent 15-year “extended use period”.

Credit Limitations

LIHTC is awarded under two different methodologies. Under either methodology, a project’s “eligible basis” is determined (for an in-depth explanation of what constitutes eligible basis, please see the QAP). Projects for new construction or rehabilitation of an existing building, if not funded by tax-exempt bonds, can receive a maximum annual tax credit allocation based on a rate which is generally 9% of the project’s eligible basis (“9% credits”). IHDA awards 9% credits based on a competitive process via two allocation rounds per year.

Projects with at least 50% of the financing coming from tax-exempt bonds can receive a maximum annual tax credit allocation based on a rate which is generally 4% of the project’s eligible basis (“4% credits”). IHDA accepts applications for tax-exempt bond projects seeking 4% credits at any time. These credits are not awarded via a competitive application round and therefore the project need only satisfy the mandatory requirements under the QAP.

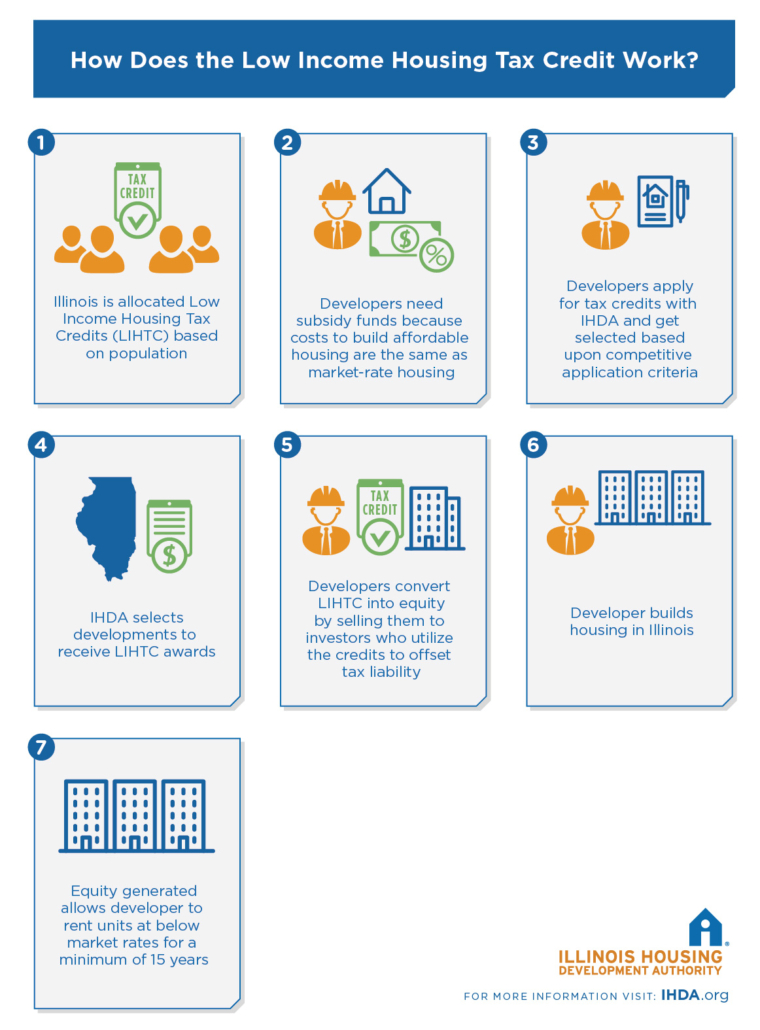

How LIHTC Works

A developer proposes a project to IHDA, wins an allocation of tax credits, completes the project, certifies its cost, and rents-up the project to low-income tenants. Simultaneously, an investor makes a “capital contribution” to the project’s owner in exchange for being “allocated” the entity’s LIHTCs over a ten-year period (syndication).The program’s structure as part of the tax code ensures that private investors bear the financial burden if properties are not successful. This pay-for-performance accountability has driven private sector discipline to the LIHTC program, resulting in a foreclosure rate of less than 0.1%, far less than that of comparable market-rate properties. As a permanent part of the tax code, the LIHTC program necessitates public-private partnerships, and has leveraged more than $100 billion in private equity investment for the creation of affordable rental housing nationally.

Qualified Allocation Plan, Regulations and Rules

The annual Qualified Allocation Plan (QAP) sets forth the criteria for evaluating all projects that apply for a tax credit allocation. The QAP takes effect upon the approval of the IHDA board and the governor.

IRS regulations for the federal tax credit program are found in Section 42 of the Code of 1986, as amended. Additionally, state rules governing the LIHTC program are found in the Illinois Administrative Code, Title 47, Chapter II, Part 350.

Applying for LIHTC

The first step in applying for LIHTCs is to submit a Preliminary Project Assessment (PPA). The PPA addresses project concept, design, location and proposed tenant population. PPAs are either approved or denied by IHDA. Approval of a PPA does not guarantee an allocation of tax credits or any other IHDA resources.

Current/Previously Approved Projects

Board Approved 4% and 9% LIHTC Allocations (Updated Quarterly)

Board Approved 4% LIHTC Allocations – 2020 – 2025. Updated January 2025

Board Approved 9% LIHTC Allocations – 2020 – 2025. Updated January 2025

Board Approved 4% LIHTC – Historical. Updated January 2025

Board Approved 9% LIHTC – Historical. Updated January 2025

Recent PPA and LIHTC Full Round Results

2025 PPA LIHTC, PSH and/or HOME-ARP Non-Congregate Shelter Program

2025 – Preliminary Project Application Submissions

2025 – Approved Preliminary Project Submissions

2025 – Low-Income Housing Tax Credit (LIHTC) Applications Received

2024 Round

2024 – Preliminary Project Assessment Submissions

2024 – Approved Preliminary Project Submissions

2024 – Low-Income Housing Tax Credit (LIHTC) Applications Received

2024 – Low-Income Housing Tax Credit (LIHTC) Approved Allocations

2023 Round

2023 – Preliminary Project Assessment Submissions

2023 – Approved Preliminary Project Submissions

2023 – Low-Income Housing Tax Credit (LIHTC) Applications Received

2023 – Low-Income Housing Tax Credit (LIHTC) Approved Allocations

2022 Round

2022 – Preliminary Project Assessment Submissions

2022 – Approved Preliminary Project Submissions

2022 – Low-Income Housing Tax Credit (LIHTC) Applications Received

2022 – Low-Income Housing Tax Credit (LIHTC) Approved Allocations

2021 Round

2021 – Preliminary Project Assessment Submissions

2021 – Approved Preliminary Project Assessment Submissions

2021 – Low-Income Housing Tax Credit (LIHTC) Applications Received

2021 – Low-Income Housing Tax Credit (LIHTC) Approved Allocations – Final

2020 Round

Preliminary Project Assessment Submissions

Approved Preliminary Project Submissions

2020 – Low-Income Housing Tax Credit (LIHTC) Applications Received

2020 – Low-Income Housing Tax Credit (LIHTC) Approved Allocations – Final

2019 Round

Approved Preliminary Project Submissions

2019 – Low-Income Housing Tax Credit (LIHTC) Applications Received

2019 – Low-Income Housing Tax Credit (LIHTC) Approved Allocations – Final

2018 Round

2018 – 9% Low-Income Housing Tax Credit (LIHTC) Applications Received

2018 – 9% Low-Income Housing Tax Credit (LIHTC) Projects Approved – Final

2017 Round

2017 – Full Applications Received

2017 – LIHTC Projects Approved – Final

2017 PPA Round II

Preliminary Project Assessment Submissions

Approved Preliminary Project Assessment Submissions

2017 PPA Round I

Preliminary Project Assessment Submissions

Approved Preliminary Project Assessment Submissions

2016 Round II

Preliminary Project Assessment Submissions

Approved Preliminary Project Assessments

Full Applications Received

LIHTC Projects Approved – Final

Round II LIHTC Scoring Ranges

2016 Round I

Preliminary Project Assessment Submissions

Approved Preliminary Project Assessments

Full Applications Received

LIHTC Projects Approved – Final

Round I LIHTC Scoring Ranges

2015 Round II

Approved Preliminary Project Assessments

Full Applications Received

LIHTC Projects Approved – Final

2015 Round I

Approved Preliminary Project Assessments

Full Applications Received

LIHTC Projects Approved – Final

2014 Round II

Approved Preliminary Project Assessments

Full Applications Received

LIHTC Projects Approved – Final

2014 Round I

Approved Preliminary Project Assessments

Full Applications Received

LIHTC Projects Approved – Final

2013 Round II

Approved Preliminary Project Assessments (Updated 6/5/13)

Full Applications Received

LIHTC Projects Approved – Final

2013 Round I

Full Applications Received

LIHTC Projects Approved – Final

2012 Round II

Approved Preliminary Project Assessments

Full Applications Received

LIHTC Projects Approved – Final

2012 Round I

Approved Preliminary Project Assessments

Full Applications Received

LIHTC Projects Approved – Final

2011

Approved Preliminary Project Assessments

Full Applications Received

LIHTC Projects Approved-Final

2010

Approved Preliminary Project Assessments

Full Applications Received

LIHTC Projects Approved, including Disaster Tax Credits-Final

2009 Round II

LIHTC Projects Approved, including Disaster Tax Credits – Final

2009 Round I

LIHTC Projects Approved-Final

Low Income Housing Tax Credit (LIHTC) Program Timeline

Preliminary Project Assessments (PPA’s) and Low Income Housing Tax Credit (LIHTC) Applications are now accepted via IHDA Connect. In order to submit your PPA or Application, you must first request a Project ID (PID) and an account for IHDA Connect, the Authority’s document management web application. Once assigned a PID for your development proposal, and access to IHDA Connect is established, all documents should be uploaded electronically into IHDA Connect.

To request an account for IHDA Connect and a PID, please click here or visit https://ppa.ihda.org to fill out the online form. Here you will be able to list members of your development team to which you would like to grant access to interact with the PID. Please allow up to three business days to receive confirmation that the account and/or PID has been created. If you have not received your account information within three business days, please reach out to IHDAconnecthelp@ihda.org.

If you have an IHDA Connect account and have forgotten your password, please use the self-service password reset option beneath the credential fields at https://connect.ihda.org.

The Illinois Housing Development Authority (IHDA) is pleased to announce tentative dates for 2025 9% Low-Income Housing Tax Credit (LIHTC) application round. Please see the key event deadlines for the 2025 9% LIHTC round below:

| EVENT | DATE |

| PPA Deadline for 2025 LIHTC Applications | Monday, October 7, 2024 |

| PPA Notification to Sponsors | Friday, December 13, 2024 |

| 2025 Applications Due | Thursday, March 6, 2025 |

| Clarification Period | April 21 – 25, 2025 |

| Recommendations to Board | Friday, June 20, 2025 |

PPA and Application Timeline 2025 4% LIHTC

- IHDA will accept 4% LIHTC applications on a rolling basis through 2025.

- Please see the 2025 Multifamily Transactions Timeframes for more information on application deadlines.

Income Averaging

As is well known throughout the affordable housing industry, Congress recently created a new occupancy set-aside option known as “income averaging.” Instead of electing the 20/50 or 40/60 minimum set-aside, an owner may elect an income averaging set-aside. This allows a property to serve households up to 80% AMI, as long as at least 40% of the total units are rent and income restricted and the average income limit for all tax credit units in the project is at or below 60% AMI.

The Authority understands its stakeholders are excited to take advantage of this new option to better serve the needs of those seeking affordable housing. Given the nuances of this new set-aside option, the Authority is carefully reviewing applicable law and industry guidance with the goal of developing a policy around income averaging that will ensure the Authority can continue to administer the low-income housing tax credit (“LIHTC”) program in the most effective and efficient way possible.

As the Authority continues its analysis of this new set-aside option, the Authority wanted to provide some information about the parameters currently being considered. The information in this bulletin is not intended to be conclusive or exhaustive. The Authority’s final policy may or may not include the elements discussed below. In addition, if determined to be applicable, the Authority will take steps to amend the 2018-2019 Qualified Allocation Plan.

Please note, developments will be ineligible to select income averaging if: (i) the development received 9% LIHTC award from the Authority in 2018 (or earlier); or (ii) the development receives a 9% award from the Authority in 2019; or (iii) the development already has a recorded Extended Use Agreement (including resyndications); or (iv) the development already filed a Form 8609.

Developments seeking 4% LIHTC’s that desire to elect income averaging will be considered by the Authority on a case-by-case basis. Tax exempt bond developments will still need to meet all applicable bond-related compliance requirements.

Additionally, the Authority is in the process of updating the Affordable Rental Unit Survey (ARUS) to reflect all the allowable income levels under income averaging. Please click the link below for additional information.

Affordable Rental Unit Survey (ARUS)

Anticipated mandatory requirements for any development requesting to elect income averaging:

- All units must be designated low income; the development may not contain unrestricted or market rate residential units.

- Designated income/rent levels may only be set at 10% increments beginning at 20% of AMI. Allowable income/rent designation levels are 20%, 30%, 40%, 50%, 60%, or 80% of AMI. The Authority reserves the right to limit the number of AMI designations per property.

Anticipated supplemental application items for any development requesting to elect income averaging:

- Written acknowledgement from the LIHTC equity investor that income averaging is compatible with requirements of other public and private funding sources.

- Written acknowledgement from the property manager regarding the compliance implications and commitment to provide annual income averaging training to on-site property management.

- Payment of an additional application fee to re-underwrite the development, if applicable.

- Payment of an additional compliance fee to reflect increased monitoring requirements for developments that elect income averaging.

- Updated common application.

- Updated market study demonstrating sufficient market demand for each income bracket proposed.

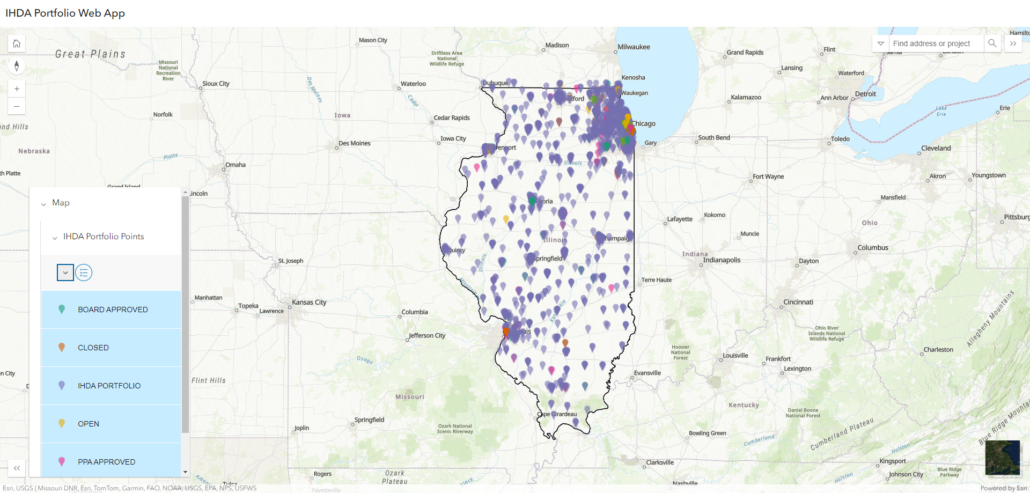

IHDA Portfolio and Pending Projects Map

IHDA Portfolio and Pending Projects Map

The status of all PPAs and applications for IHDA resources, as well as IHDA’s current portfolio, can be found via the fully searchable mapping tool (updated March 2024.)